See A Need, Fill A Need

Alex Zachman/Correspondent

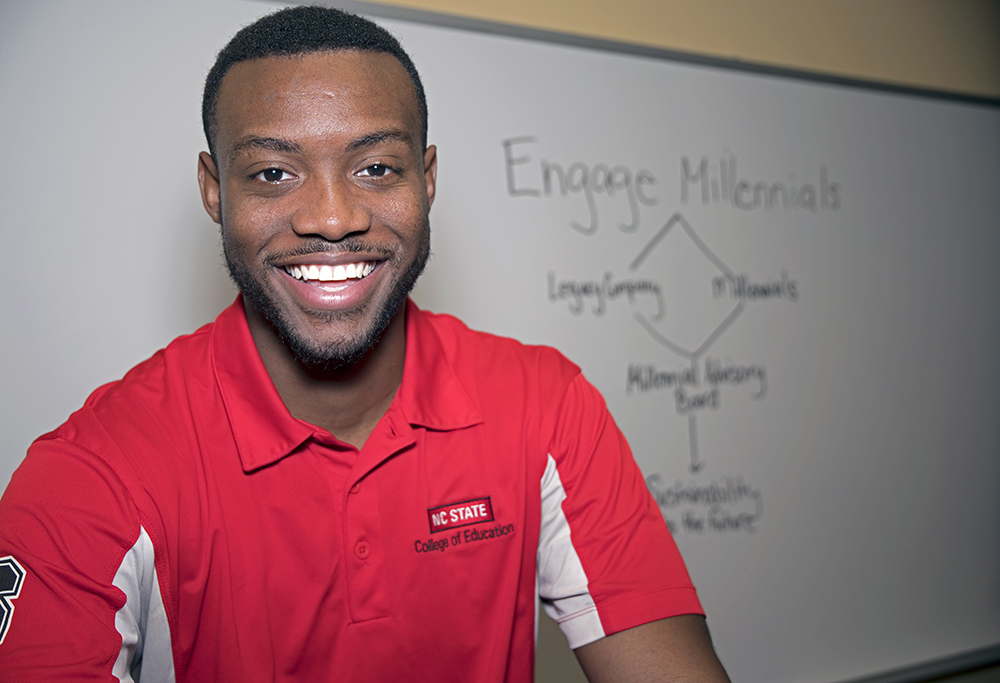

26-year-old Marcus Howard is on M&F Bank Millennial Advisory Board with the goal of helping the bank reach out to millennials. Howard is also the president of the NC State Black Graduate Students Association, which he helped found in 2016.

Kennysha Woods | Correspondent

In today’s day and age, one wouldn’t expect a handwritten letter to catch the attention of the CEO of any business, but Marcus Howard has found out otherwise. It was a letter that led him and his business partner and best friend, Charles Hands III, to the CEO of Mechanics and Farmers Bank, James Sills III.

“We had to be different,” Howard said. “He gets a ton of emails and messages from the [bank’s] website. We got a call three days later.”

Some of you may know Howard as a second-year graduate student in education policy, leadership and development and the founding president of NC State’s Black Graduate Student Association since January 2017, but he also co-owns Engage Millennials, LLC with Hands, and serves as a chair on M&F Bank’s new Millennial Advisory Board.

However, the story begins before the letter, with Howard and Hands’ interest in black-owned businesses throughout history.

“We would read black history books,” Howard said. “We read about the Reconstruction period and Black Wall Street, and how prosperous Black Wall Street was in the 1920s. So we wanted to see that in the current times. We read a book called ‘Black Business in the New South,’ and it was about historically black businesses in North Carolina. One of those businesses was M&F Bank.”

M&F Bank started in 1907 and is the second oldest minority-owned bank in the country.

Howard and Hands sought to support the bank, but one unpleasant visit deterred them from investing. “We had a bad experience with service, technology and the aesthetics of the building. We were disappointed,” Howard recalled. “Most millennials don’t even tolerate a first bad experience.”

He added, “The next generation are millennials. They’re the largest demographic in the United States right now and in order to sustain growth into the future, you’re going to need them as customers.”

Howard and Hands didn’t want to put their money into a business they didn’t have confidence in, but they also didn’t want the bank to disappear with their older customers. They wanted to remedy the old building, improve the staff’s knowledge of available products, and update the bank’s website, but the primary concern they had was the bank’s lack of presence on social media. They believed it was causing a disconnection between the bank executives and millennials.

“A lot of people don’t realize that a lot of senior executives are old, and don’t know a lot about social media,” Howard said, “but social media is like the most effective and free way to engage people and advertise. It’s a need, and they don’t know how to use it.”

So they sent the letter, and after a series of meetings with bank executives, the Millennial Advisory Board was created to bridge the bank with the millennial demographic and stimulate the surrounding community.

Additionally, Howard and Hands helped improve the bank’s social media utility, update the website, and spark building renovations and production of millennial-specific products set for release in January 2018.

But disconnection with the younger generation isn’t a problem limited to M&F Bank. “There were other minority-owned businesses across the country that had the same issue,” Howard said. “If we could create a solution for [M&F Bank], we could create solutions for all of these businesses.”

That’s where Engage Millennials comes in; Howard and Hands use the startup to help older companies with older executive leadership develop products, services and advertisement strategies that appeal to millennials.

“I think Charles and I want to inspire other millennials, particularly in the minority community, to look within their community for problems and create those solutions,” Howard said. “Finding a solution is not necessarily having a particular degree or being in a certain field of work. The solution is always right inside of you. I majored in education and in science in undergrad. I don’t have a business degree anywhere.”

They also want to help invigorate the surrounding community. “Banks are staples in communities, and we want to help revitalize low-income communities,” Howard said. “To do that, you need a strong financial institution, strong businesses with money flowing in and out.”

In pursuing their business opportunities, Howard has learned two vital lessons he advises every young, aspiring entrepreneur to know.

“Something important we learned was relationship-building,” Howard said. “We knew what we were talking about and we knew what our solutions were. But we had to get access to the people who could enact and affect change–the CEOs. Relationship-building is very, very important. Until you’re able to build genuine relationships with the people in charge, you’ll never be able to make that connection.”

His second piece of advice is to “find a need and fulfill a need.” Howard said, “If you’re an aspiring entrepreneur, instead of looking for ways to make money, look for problems and needs in the community and try to find innovative ways to fill those needs.”

Howard emphasized the importance of pursuing entrepreneurship in order to find solutions for problems rather than creating a business with the intention to make money. “We had other businesses that failed,” Howard said, “Party-promoting companies, event-planning, tutoring business. All of this stuff was fueled by [the intent] to make money. With this business, we found a genuine need in the community, and we filled that need, and it turned into a business.”

- Categories: