Student Financial Need on the Rise

CJ GUION | EDITOR – IN – CHIEF

Last week, it was reported in the New York Federal Reserve’s latest report on Household Debt and Credit, that for the first time student loans will surpass the $1 billion mark. According to the Fed, that means that credit card debt and student debt is almost equal. This year on campus, the Office of Financial Aid and Scholarships has seen a surge in students applying for need-based assistance.

The Vice Provost and Director of Scholarships and Financial Aid Julie Rice Mallette said “As the cost goes up each year, more students are applying for and needing financial aid.” One problem with that is that there is simply not enough money to go around.

Just this year, several options for aid Federally and State-Wide have been cut such as the Academic Competiveness Grant, the Smart Grant, the North Carolina Incentive Grant, and the Robert C. Byrd Scholarship. The North Carolina Incentive Grant previously provided $700 to incoming freshman their first year. However, the state government could not handle the cost, so the Federal government dropped out as well and the grant was abolished.

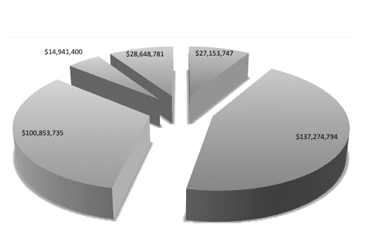

In all, NC State University lost 3 million dollars in federal aid and 5.5 million in State aid. At the same time there was an increase of 19 million dollars of student need. That is a net swing of 27 million dollars of growth just this year that the university is lacking in money for students.

Last year, one program that has helped many students which would not normally have the funds to pay for school, the Pack Promise was almost cut due to budget cuts. However the Office of Scholarships and Financial Aid worked with the Provost and Vice Chancellor for Finance and Business to make changes to the program so that those students could still have an equal shot at an education. Mallette said “we simply couldn’t continue to serve an unlimited number of students. In order to keep class sections at a steady rate, changes had to be made.”

Effective this year, the Pack Promise is only available to in-state residents. It will be limited to 200 incoming students, and the maximum amount of need-based loans will increase from $2500 to $3500. The program promises to fulfill 100% of the financial need for students who are a part of the program and also offers funding and academic support. As of the moment, 198 out of the 200 students who were admitted into the Pack Promise program this year are still enrolled.

Many students will notice the affects of the recent budgets cuts beginning with summer school, which will not have as much aid available, which has not been a problem in the past. Mallette said that the university has already reached it’s ceiling of $3 million dollars in Federal Perkins Loans. “One thing that bothers me is that many students have resorted to other agencies for student loans which typically might have higher interest rates.” In the past, we have not had a high number of students to default on their loans, and I hope that trend continues.

- Categories: